![Louisiana CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2020/10/Louisiana-CPA-CPE-Requirements.png)

CPE Requirements for CPAs in Louisiana

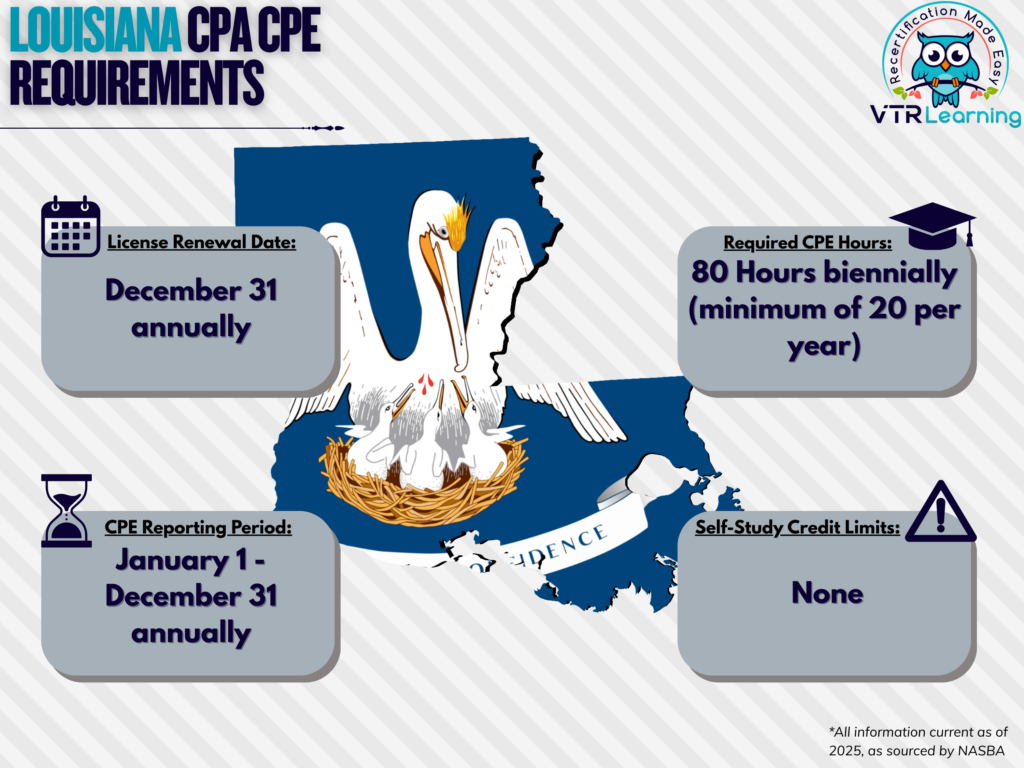

CPE is the bedrock for CPA licensure. In fact, it’s a foundation that holds up the walls of a professional career by ensuring individuals stay up-to-date with industry standards. However, not all CPAs have the same state requirements when it comes to license recertification requirements and CPE. Because different Boards of Accountancy oversee and regulate each state in the U.S. So, the stipulations naturally vary from place to place. Consequently, Louisiana CPAs must renew their license yearly. And in that time, they must complete at least 20 hours of CPE. However, they must also complete 80 hours total every two years. The table below also points out some of the primary Louisiana CPA CPE requirements.

Share this Image On Your Site

Louisiana CPA CPE Requirements and Recertification Deadlines

| License Renewal Date | CPE Reporting Period | Total CPE Hours | Self-Study Credit Limitations |

| December 31 annually | January 1 – December 31 annually | 80 hours | Must be interactive |

Subject Area Requirements

In Louisiana, each licensee must also complete a course in professional ethics. But the Board must pre-approve the contents of this course in order to qualify. Typically, this requirement is for 3 CPE credit hours.

Those who participate in attest engagements must complete at least 8 hours in Accounting and Auditing subjects each year. This includes responsibility for performing substantial portions of the procedures as well as planning, directing or reporting on attest engagement. Persons who plan, direct and report generally include the in-charge accountant, supervisor or manager. Also, the firm partner who signs or authorizes someone to sign the attest engagement report on behalf of the firm.

Credit Limitations and Calculation

Licensees who instruct presentations or lectures can earn up to 20 CPE hours each recertification period. However, they cannot earn further credit for repeat instructions without substantial revisions. When calculating, credit equals presentation plus preparation times. But preparation credit cannot exceed twice the presentation length.

Furthermore, licensees taking courses at an accredited university can claim up to 15 CPE hours per semester hour completed. Alternatively, if the individual takes a quarter-year course, up to 10 CPE hours per quarter hour successfully completed. Also, audit hours are worth 1 CPE credit hour.

Personal development courses are accepted for CPE credit, though this method is limited to 20 hours per year.

Individuals can obtain credit for authoring and subsequently publishing instructional or educational material. But this method may not exceed 10 hours per calendar year. Also, credit for authorship will only be awarded in an amount to be determined by a Board representative. This method only accrues in whole hours.

Only interactive self-study will be approved for CPE credit. The Board will accept half credits prior to the licensee earning the first full hour. However, for most other CPE methods, half-hour credits cannot be obtained until after earning the first full hour.

CPAs can obtain credit for successfully completing exams such as the CMA, CISA and CFP. This method calculates as 5 credits per exam hour passed, but cannot surpass 20 hours per calendar year.

Of course, magazine and reference material readings and tests do not qualify for CPE credits.

Other Policies and Exemptions

Some CPAs are exempt from license renewal requirements so long as they refrain from offering their services to any parties. The categories below describe qualifying conditions:

- Retired persons

- Unemployed persons

- Persons who have temporarily left the workforce

- Formally listed “inactive” persons

Exemption waivers are available upon request for any individual for the following reasons:

- Issues and/or complications with health

- Military service

- Natural disasters or pandemics of an extreme level (Board approved)

- Any similar situation which could prevent a CPA from completing recertification requirements

Additional CPE Resources for CPAs

Last Updated:

![North Dakota CPA CPE Requirements [Updated 2025]](/wp-content/uploads/2021/05/North-Dakota-CPA-CPE-Requirements.png)

![Find Your Required CPA CPE Hours [State Chart]](https://assets.vtrlearning.com/wp-uploads/2025/03/Find-Your-CPE-Hours.png)